What is Venmo App Development Cost?

Creating an app like Venmo requires a user-friendly structure for easy peer-to-peer transactions. This app allows users to easily split bills, transfer money, and make purchases using their mobile devices. Immediate transfers, social interactions, and secure transactions are essential features.

To do well in this tough industry, your app must prioritize user experience, security, and following financial regulations. Your app will do well if it uses new technology and follows best practices in development, making users happy.

What is a Venmo?

The Venmo mobile payment service users can send money to each other. PayPal owns Venmo, and people often use it for small transactions, paying friends, and dividing bills. Users can connect their credit, debit, or bank cards to the app for easy transfers. In addition, Venmo includes social media-like capabilities.

For example, users may note transactions, which are notes that appear in a social feed. Apps make it easy to send money to friends without using cash or checks. It's fast, safe, and convenient. Credit cards, debit cards, or bank accounts are connected and can be used to make Venmo transactions.

How Does Venmo Work?

Venmo is a famous mobile payment app that makes transferring money between consumers easier. Users have to download the Venmo app and register by connecting their credit card, debit card, or bank account. After completing the setup process, users can search for their contacts within the app to transfer or receive money.

If you include notes, emojis, or gifs with the transaction, payments become more social and open. Venmo transactions are quick and safe, making sharing bills, paying pals, and buying products and services accessible. The app also offers a Venmo card for direct spending from the Venmo balance.

Cost To Develop a P2P Payment App Like Venmo

Developing a peer-to-peer (P2P) payment app similar to Venmo involves several costs. The main costs are front-end and back-end development, payment gateway integration, and app design. The average cost of developing an app is between $50,000 and $150,000, depending on its features and complexity. Essential features like social feed integration, user authentication, safe transactions, and customer support increase the budget.

Updates, continuous maintenance, and compliance with financial requirements all come at an additional cost. Working with a trusted development team guarantees a safe and simple application. Marketing and user acquisition techniques also cost money to attract and maintain customers in the competitive P2P payment business.

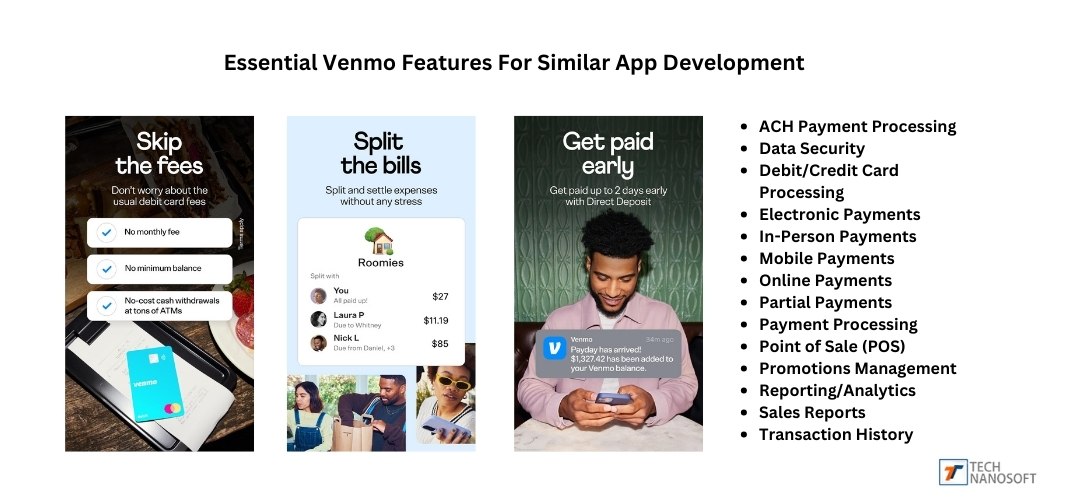

Essential Features For App Development Like Venmo App

ACH Payment Processing

In the US, people use ACH (Automated Clearing House) to transfer money between bank accounts electronically. Peer-to-peer payment apps are important because they allow safe and effective bank transfers directly between users.

Automatic deposits, bill payments, and other periodic transactions frequently occur via ACH payments. This feature gives a safe option for credit card payments and lowers user transaction costs. A peer-to-peer app helps with ACH payments and makes it easy and cheap to send money, improving user experience.

Data Security

The P2P payment app requires data security to protect users' personal data from hackers and illegal access. You can achieve protection of personal and financial data by implementing robust encryption techniques, secure authentication procedures, and conducting frequent security audits. Security is further improved by following industry standards like PCI DSS (Payment Card Industry Data Security Standard).

A secure app increases user trust by avoiding information hacking and promoting a safe environment for financial transactions. Maintaining data security is a top priority to maintain the quality of the application and customer confidence.

Debit/Credit Card Processing

Direct card payment becomes possible for users via debit and credit card processing. This functionality, which offers a valuable and flexible payment alternative, is essential for P2P payment apps. To protect cardholder data, integrating card processing requires collaborating with payment service providers and ensuring PCI DSS compliance.

The app allows users to connect their credit or debit cards, allowing quick payments and transactions. Providing this feature increases the app's popularity to a broader audience and improves user comfort. A faultless user experience depends on secure and dependable card processing.

Electronic Payments

Electronic transactions include the digital transfer of funds, eliminating the need for cash or cheques. This feature allows users of P2P payment apps to send and receive money securely and swiftly. There are multiple methods to make electronic payments, such as using a mobile wallet, cards, and bank transfers.

Adding electronic payment features to the app makes it more flexible and allows for a broader range of user needs. Users enjoy the app for its speed, efficiency, and convenience compared to traditional payment methods.

In-Person Payments

In-person payments, individuals can utilize their mobile devices to complete transactions with each other. P2P payment apps are greatly helped by this feature, allowing users to quickly send and receive money while talking in person. Users can comfortably and efficiently conduct transactions using near-field communication (NFC) technology or scanning QR codes.

Adding in-person payment capabilities that support different payment situations increases the app's functionality. This functionality improves consumer convenience by offering a smooth and flexible payment experience in both online and offline settings.

Mobile Payments

Mobile payments involve conducting financial transactions, providing a practical substitute for traditional payment systems. People can send and receive money on their phones or tablets with P2P payment apps that have mobile payment options. This feature uses mobile wallets, NFC, and QR codes to allow safe and quick transactions.

Mobile payments increase customer satisfaction by simplifying transactions on journeys and expanding the app's popularity. For a perfect mobile payment experience, connectivity with several mobile platforms and integration of solid security measures are essential.

Online Payments

Online payments facilitate faster transfer of funds over the internet, allowing consumers to finish transactions from any location. Online payment features let users of peer-to-peer payment programs send and receive money using a mobile app or website. Users can easily transfer money to others and receive money from them through online payment features.

These features are available on both mobile apps and websites for convenience. Digital wallets, card payments, and bank transfers represent just a few of the payment options supported by this functionality.

Adding online payment options makes the software easier to use and available to people who like to buy things remotely. A dependable user experience depends on safe and effective online payment processing.

Partial Payments

Partial payments allow users to split a transaction into multiple payments, offering flexibility to manage expenses. This functionality will enable users of P2P payment apps to easily divide bills, share costs, and submit additional payments. Incorporating partial payment functionalities improves the app's flexibility, supporting diverse payment situations.

This feature is helpful for combined spending, installment payments, and group activities. Offering partial payment options improves user convenience and promotes collaboration in the app's handling of the cash process.

Payment Processing

P2P payment apps utilize payment processing to make it easier for users to transfer funds. This feature addresses every stage of the transaction lifecycle from authorization to settlement. We guarantee accurate and timely transaction completion by integrating secure and effective payment processing.

It involves establishing partnerships with payment gateways, ensuring financial rules are followed, and having fraud safeguards first. Offering a smooth transaction experience and maintaining customer trust depends significantly on secure payment handling. Improving this feature increases user satisfaction and the software's performance.

Point of Sale (POS)

Point of Sale (POS) systems allow businesses to receive customer payments physically. Users of P2P payment apps can use their mobile devices to make payments personally via POS capabilities. This tool supports various payment options, such as QR codes, mobile wallets, and cards.

Adding POS features improves the app's functions, helping sellers, freelancers, and small businesses. Ensuring that point of sale system transactions are safe and effective can make users feel more comfortable. This will also increase the app's usefulness for various payment scenarios.

Promotions Management

Managing marketing campaigns and special offers in a peer-to-peer payment app is called promotions management. App owners can use these features to create marketing campaigns that attract users with discounts, cashback, and referral bonuses.

Increasing app usage with connection to marketing management increases user engagement. Building up campaign criteria, maintaining updates on performance, and analyzing results. The app's success depends on good promotion management. This helps increase transactions, keep customers coming back, and attract more clients.

Reporting/Analytics

Analytics and reporting provide valuable data on app performance and user interactions. This functionality of P2P payment apps involves collecting and assessing transactions, user activity, and accounting data. By integrating analytics and reporting features, app admins could identify patterns, make well-informed decisions, and simplify workflows.

This tool helps you make reports, analyze data with dashboards, and set up notifications for important indicators. Accurate reporting and analytics improve decision-making and transparency and support the app's strategic expansion.

Sales Reports

Sales reports give full details about the revenue gained via the P2P payment application. App admins use this feature to monitor sales performance, spot trends, and measure the success of marketing campaigns. Creating complete reports, rating sales based on numerous factors, and collecting transaction data are all part of integrated sales reporting abilities.

Sales data helps evaluate the app's revenue, improve pricing strategies, and identify possibilities for growth. Making smart decisions and maintaining the app's success depends on precise and rapid sales data.

Transaction History

The P2P payment app's transaction history provides an extensive record of all financial transactions performed. Customers can manage their financial activity, maintain records of payments, and view previous transactions with this feature. Offering a user-friendly interface for accessing records and safely conserving transaction data is essential to combining historical transaction features.

This feature increases transparency by enabling users to verify transactions, resolve conflicts, and keep the correct financial records. Offering an extensive transaction history increases user trust and offers insightful information about their financial patterns.

Side Cost To Develop A P2P Payment App Like Venmo

App Wireframe

An application wireframe is a visualization of a mobile application's basic structure. It serves as an outline for the functionality, design, and user experience. A full wireframe needs to ensure that it correctly positions all parts to understand the app. It allows the visualization of the user journey and early identification of potential issues during development.

Wireframes are important for showing design ideas to developers and clients, making the development process more efficient and successful.

App Design

A mobile application's engaging and visual components belong to the app design. It includes creating images, user interfaces, and general attractiveness that improve the user experience. An effective app guarantees that it is visually appealing, simple, and accessible.

It combines user interface (UI) and user experience (UX) design. Excellent app design attracts users, maintains their attention, and promotes positive interaction. Making a good initial impression and ensuring permanent user pleasure require investing in competent app design.

App Type

The type of app being developed offers a significant impact on the development process and overall expenses. The app involves financial technology (FinTech) peer-to-peer payment services like Venmo. The features, security protocols, and regulations differ based on the type of app. Although native apps are costly, they work better specifically for a specific operating system (iOS or Android).

Cross-platform applications that run on several operating systems are affordable, although they may sacrifice functionality. Selecting the correct category of app is essential to fulfilling user expectations and achieving company goals.

Team Size and Location

The cost and quality of app development significantly affected the size and location of the development team. Although a larger team may result in higher expenses, it can speed up development. On the other hand, a more minor team could operate more quickly but more cheaply.

The team's location affects costs. Developers in North America and Western Europe usually charge more than those in Asia or Eastern Europe. Maintaining high expectations and maximum productivity and cost management demands balancing team size and location.

Tech Stack

Choosing the right tech stack for a P2P payment app is crucial to its scalability, security, and performance. Java, Swift, and Kotlin are used for mobile development, while Node.js, Python, and Ruby on Rails are common for backend technologies in programming.

Integrating databases, cloud services, and secure payment channels is crucial. Selecting a powerful and efficient tech stack is important for ensuring a seamless user experience. It also helps the app to grow and remain well-maintained in the long term.

READ ALSO- What is DeFi (Decentralized Finance), How Does it Work?

Venmo Alternatives App

PayPal

PayPal is a popular online payment system that allows safe money transfers for individuals and organizations. It supports payment options like PayPal balances, bank transfers, and credit cards. PayPal offers buyer security, providing secure online transactions.

Additionally, it comes with a smartphone app for easy payments. PayPal is a great platform for personal and business transactions. It has strong security measures and is used worldwide, making it stand out from other payment tools.

Stripe

stripe is a powerful online payment processing platform designed for companies of all kinds. It supports numerous payment options, such as digital wallets, debit cards, and credit cards. Stripe's API-driven method allows smooth integration with mobile applications and websites, providing flexible payment options.

Advanced capabilities like identifying fraudulent transactions, real-time analytics, and automatic billing. Stripe is a great option for businesses looking for secure and efficient payment processing. It has developer-friendly features and thorough documentation.

Square Payment

Square Payment allows businesses to easily accept payments both online and in person, making it a convenient payment processing option. Simple handling of credit cards becomes possible via its mobile apps and physical products, such as Square Reader. Square offers Invoices, automatic payments, and an online terminal for manual entry as additional capabilities.

Square is excellent for startups and small enterprises since it has upfront costs and no commitments for a while. The platform allows effective control of sales, inventory, and customer interactions via its integration with several business tools and analytics capabilities.

SpotOn

SpotOn provides a complete platform for business management and payment processing for small and medium-sized enterprises. It offers a variety of tools, such as marketing, customer engagement, and point-of-sale (POS) systems. Online, mobile, and debit card payments are all facilitated by SpotOn's payment processing.

The platform also provides analytics and reporting tools to help companies track customer behavior and sales performance. The SpotOn strategy simplifies payment processing, improves customer service, and helps businesses grow in the industry.

Square Point of Sale

The Square Point of Sale (POS) has many features and an easy system to help businesses manage in-person transactions effectively. It supports Gift cards, contactless payments, and credit and debit card payments. Customer-related tools, sales reporting, and inventory management are all integrated into the Square POS app.

It provides a full solution for retail, food service, and service-based businesses, with easy connection to other Square services. Square POS is a good choice for businesses looking for a dependable and versatile point-of-sale system. It has an easy-to-use interface and can be customized to fit your needs.

QuickBooks Online

One of the best accounting software programs is QuickBooks Online, which has integrated payment processing features. Businesses can track expenses, make invoices, and receive online payments using a single platform. QuickBooks Online gives users versatility by allowing them to take payments using ACH, credit card, and debit card.

Businesses can monitor financial performance and simplify accounting responsibilities with the help of the software's robust reporting and analytics features. QuickBooks Online is the best option for small to medium-sized businesses seeking to streamline financial management and increase the effectiveness of payment processing because of its intuitive interface and broad list of features.

How Does Venmo App Make Money?

Venmo makes money through several revenue streams.

1. Instant Transfer Fees: If customers prefer to directly transfer money from their Venmo account to their financial institutions, Venmo charges a fee. This solution avoids the typical venmo transfer limit time of one to three business days and offers instant access to funds. Instant transfers' simplicity attracts customers ready to pay a small fee for faster access to their funds, offering Venmo an ongoing supply of income.

2. Credit Card Transaction Fees: Venmo generates revenue from Fees on credit card payments made using the app. These transaction fees considerably increase Venmo's revenue by paying for the costs related to processing credit card payments. Venmo makes it easier for users to manage credit card transactions and charges fees to make money.

3. Venmo Card Interchange Fees: The Venmo Card, a debit card connected to users' Venmo accounts, generates revenue through interchange fees. Retailers are responsible for paying costs whenever a Venmo Card transaction is performed. Venmo makes money from every transaction users make with retailers, ensuring a steady income stream.

4. Business Profiles Fees: Venmo offers business profiles for receiving payments utilizing the app. Every transaction completed via these company profiles experiences a small fee from Venmo. This functionality not only gives businesses a practical way to accept payments but also gives Venmo an additional source of income, increasing its financial viability and business transactions.

5. Interest on Funds: Venmo receives returns on any funds users maintain in accounts. Venmo invests customer money as it remains within their balances, generating interest until the funds are moved or withdrawn. Using user deposits to create extra revenue, Venmo's tackle of collecting interest on unused funds helps its overall revenue.

READ ALSo- How to Create an App: 7 Essential Steps in 2024

Innovative Approach With Technanosoft To Develop A P2P Payment App Like Venmo

Innovating in developing a P2P payment app, Technanosoft focuses on scalability, security, and user experience. Technanosoft uses blockchain and AI to keep data safe and make processes more efficient, like secure transactions and fraud detection. Their adaptable process allows for quick changes and customer input, creating a user-friendly experience.

Technanosoft also combines social media features, real-time transfers, and extensive reporting capabilities. The system is dependable and easy to use.

It follows current financial rules and regulations. It focuses on these aspects. The system offers a P2P payment system.

FAQs

Q.1- How to Make an App Like Venmo?

A- Making an app similar to Venmo requires a few essential steps. To understand customer requirements and competitors:

1. Establish market research.

2. Create a user-friendly interface and wireframes.

3. Create a backend that processes payments securely, utilizing blockchain technology to improve security.

4. The features include quick transfers, social feeds, and peer-to-peer transactions.

5. Verify adherence to financial regulations.

6. Examine the program closely for errors and security flaws.

7. Launch the app at last, and keep recording user input to ensure it may be improved.

9. Working with a skilled development team helps simplify this challenging procedure.

Q.2- Is Venmo Available for Both iOS and Android Devices?

A- Venmo is accessible on iOS and Android smartphones. Customers can download the app via the Google Play Store for Android smartphones and the Apple App Store for iOS devices. Users can send and receive money, examine transaction history, and easily manage their accounts using the app's similar interaction across both platforms. By ensuring support with both operating systems, the application increases access and extends its user base, which makes it a versatile tool for peer-to-peer payments.

Q.3- How Long Does It Take for Venmo to Transfer?

A- Standard and instant transfers are the two options Venmo offers. The free standard transfers frequently require one to three business days to finish. With the possible exception of a small fee, instant transfers usually take a few minutes and provide immediate access to funds.

The recipient's bank processing times and other factors may affect the duration. Customers can choose the transmission type that most closely meets their requirements as balancing price and speed. For urgent transactions, instant transfers are beneficial because they guarantee quick fund availability.

Q.4- Why You Shouldn't Use Venmo-like App?

A- Utilizing an app similar to Venmo involves some risk. Users may risk fraud and data breaches due to security flaws. Users are susceptible to fraud since some apps provide sufficient consumer security or prevention. These apps might also violate all financial requirements, resulting in legal issues.

There may also be downsides, such as transaction fees and usage restrictions. Evaluating the app's security features, customer feedback, and adherence to financial rules is essential before entrusting it with important transactions or private data.

Q.5- How to Create a Venmo Account?

A- It's easy to create a Venmo account. Get the software from the Google Play Store or the software Store. Launch the app and register with your Facebook account, phone number, or email address. Choose a secure password and confirm your phone number or email address.

For payment of operations, link your Venmo account to your bank account, debit card, or credit card. To complete the setup process, follow the directions and, if required, confirm your identity. You can use the app to send and receive money once you set up your account.