What is DeFi (Decentralized Finance), How Does it Work?

Inefficiencies, high fees, limited accessibility, and a lack of transparency plague the current financial system. Decentralized finance (DeFi) solves these issues by using blockchain technology to eliminate agents, lower costs, and improve security. It makes the financial system more transparent and beneficial for everyone. There are several steps to developing a DeFi app: ideation, technical design, coding, testing, and launching the app.

FinTech companies need to be aware of this information, which is critical to leveraging DeFi potential. This blog post talks about what influences the making of DeFi apps. It covers different types of decentralized apps, important features, the development process, and challenges that come with it. DeFi apps are affected by various factors.

These include the types of decentralized apps and their key features. The development process of DeFi apps is also discussed in the blog post. It outlines the steps involved in creating these apps. Additionally, the blog post addresses the challenges associated with developing DeFi apps.

It highlights the obstacles that developers may face in the process. The goal is to give everyone who wants to create in the financial sector a complete guide.

What is Defi App?

Decentralized Finance (DeFi) apps are blockchain-based applications that allow financial transactions without relying on traditional banks or agents. Smart contracts facilitate activities such as lending, borrowing, trading, and earning interest. DeFi apps provide users with greater control, offering transparency, protection, and quick access.

DeFi wants to make finance more inclusive and efficient. It does this by eliminating middlemen and utilizing blockchain technology. This allows financial services to be accessible to everyone and know below about the types of DeFi apps.

Decentralized Exchanges (DEXs)

Decentralized exchanges allow for direct peer-to-peer cryptocurrency trading. They enhance users' security and privacy by allowing direct wallet-to-wallet transactions. Some well-known DEXs are Uniswap and SushiSwap, offering liquidity pools, automated market making, and lower trading fees compared to standard exchanges.

NFT Apps

Non-fungible token (NFT) apps allow consumers to make, buy, sell, and trade NFTs. Tokens represent ownership of unique digital assets like art, collectables, and virtual real estate. Websites like OpenSea and Rarible help people buy and sell NFTs, supporting artists, creators, and collectors in the online economy.

Crypto Wallets

Cryptocurrency wallets protect users' digital assets and allow for management. They support a variety of cryptocurrencies and provide features such as transaction tracking, portfolio management, and safe key keeping. MetaMask and Trust Wallet are two examples. These wallets provide users with control over their private keys and make it simple to connect with DeFi platforms.

P2P Lending and Borrowing

Peer-to-peer (P2P) lending and borrowing platforms allow lenders and borrowers to communicate directly, bypassing traditional financial institutions. Users can earn interest and borrow money at low rates. Smart contracts make deals safe and simple on platforms like Aave and Compound.

DeFi Crowdfunding Platforms

DeFi crowdfunding platforms allow fundraising through decentralized networks. These platforms enable project creators to raise capital by issuing tokens, which backers purchase. In the DeFi space, platforms like Kickstarter and Indiegogo offer more openness, lower fees, and access to people all over the world for both producers and investors.

DeFi Banking

DeFi Banking offers traditional banking services, but in a decentralised way. People can save money, earn interest, and pay each other directly. Platforms like Celsius and Nexo use blockchain technology to make these services safer and more efficient. They offer crypto-backed loans, high-yield savings accounts, and other financial services.

How Does Defi App Work?

DeFi apps utilize blockchain technology to operate smart contracts to automate financial transfers without intermediaries. Crypto wallets allow users to connect with these decentralized applications (dApps), which enable trade, lending, and borrowing. Coded with individual conditions, smart contracts autonomously execute transactions when criteria meet, ensuring transparency and safety. For peer-to-peer trading, DeFi platforms use decentralised exchanges (DEXs).

If you're looking to borrow money and earn interest, it's essential to use decentralised lending protocols. DeFi apps use blockchain records to create a trustless environment.

This lowers fees and improves access to financial services. It also makes financial services more democratic worldwide. This benefits everyone and increases efficiency.

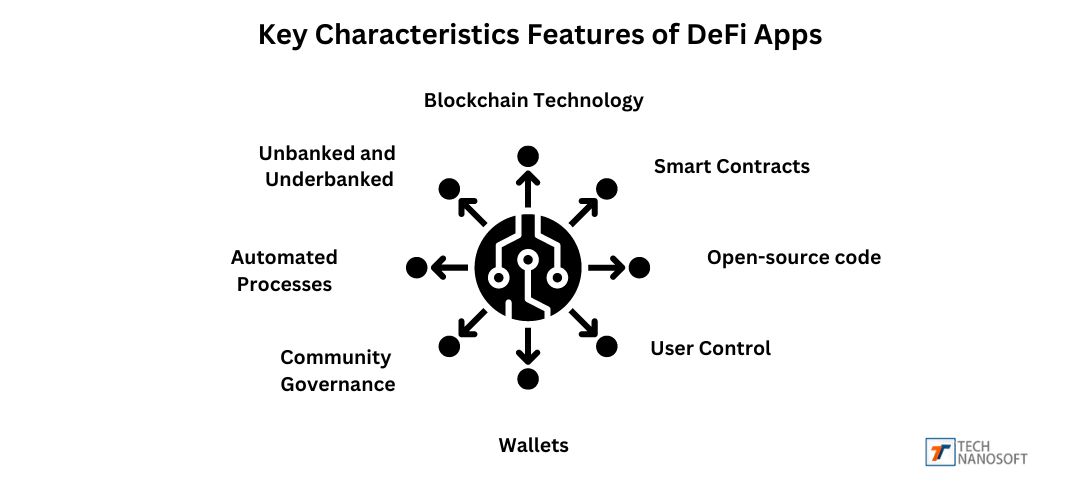

Key Characteristics Features of DeFi Apps

Blockchain Technology

DeFi apps function without a central authority because they use blockchain systems like Ethereum. These apps use blockchain to ensure that everything is clear, safe, and unalterable. A decentralised ledger records all transactions, making them tamper-proof and verifiable by anyone.

Because it is autonomous with no agents, it reduces costs and increases consumer trust. The DeFi ecosystem uses tokens created by blockchain technology for various purposes such as governance and incentives, thereby bolstering the decentralised financial scene.

Smart Contracts

The terms of a smart contract written straight into code so that the contract will carry out itself. They automatically execute deals when certain conditions met, removing the need for intermediaries like banks or brokers.

This technology enhances efficiency and mitigates the risk of human errors and fraud. Smart contracts in DeFi simplify financial activities like trading, lending, and borrowing. They ensure that transfers happen as intended. This builds trust and reliability in decentralised financial services.

Open-source Code

DeFi apps use open-source code, making their software accessible to the public, auditing, and improving it. Because of this, developers from all over the world contribute to the codebase, find security holes, and suggest ways to make it better. Open-source development encourages new ideas and teamwork, which makes apps safer and more reliable.

People who use the app can be confident that it is open because they can see how it works and check that there are no backdoors or hidden features. This builds trust and safety in the DeFi environment.

User Control

In DeFi, users keep their secret keys and digital assets, so they are in charge and own them completely. Intermediaries manage funds in traditional financial systems. DeFi lets users interact directly with protocols, reducing the risk of hacks and issues with central custody.

This user-centered method gives people the power to handle their finances, which increases privacy and security. Users can use different DeFi services with trust. Because they control their assets, they are in charge of their own money.

Wallets

Non-custodial wallets important for DeFi because they let users control their funds without relying on others. People can store, send, and receive digital assets with wallets, and they keep full control of their secret keys.

Users can easily access and use various financial services such as trading, lending, and borrowing by connecting with DeFi platforms. This can be done directly from their wallets. Non-custodial wallets improve security and privacy by keeping users in charge of their funds at all times.

Community Governance

Many DeFi projects use decentralized governance methods, which allow the community to join in decision-making processes. Token holders can suggest, debate, and vote on changes to the system. All users can benefit from these changes.

This democratic approach fosters a sense of ownership and responsibility, which encourages openness and acceptance. When the community is involved in decision-making, they can better serve their users and maintain a decentralized and robust environment.

Automated Processes

DeFi leverages smart contracts to automate complex financial operations like trading, investing, lending, and borrowing. DeFi computerizes these automated processes, eliminating the need for agents. This reduces costs and boosts efficiency. Smart contracts ensure the correct execution of deals by adhering to pre-established rules.

This lowers the risk of mistakes or fraud. Automation creates new financial products and services that work smoothly and non-stop. These options help users manage their assets in a decentralized way. Users have a variety of choices for managing their assets.

Unbanked and Underbanked

DeFi helps people without bank accounts or limited access to banks by giving them financial services without traditional banks. People can trade on global financial markets, get loans, save money, and invest online. Just need internet access.

DeFi eliminates barriers like high fees, credit checks, and limits on where you can live so that more people can use banking services. By using blockchain technology, DeFi creates opportunities for economic empowerment and gains economic power.

READ ALSO- What is Mobile CRM For Business?A Full Overview

Essential Steps to Develop a Defi Apps

Project Idea

Start with a clear and innovative project idea. Discover a unique financial problem that your DeFi app can solve. Think about things like loans, borrowing, trading, or any other type of financial service. Research your target audience and understand their needs.

Make a detailed plan that lists all of your DeFi app's features, functions, and benefits. A well-thought-out project idea is key to a smooth development process and ensuring that your app meets user needs.

Pick The Right Blockchain Platform

Choosing the right blockchain technology is critical to the success of your DeFi app. Platforms like Ethereum, Binance Smart Chain, or Polkadot offer robust tools for DeFi development. Consider factors such as transaction speed, growth potential, security, and group support.

Check out the ecosystem, software tools, and documentation for the platform. The blockchain you choose should meet the needs of your app, allowing for simple connection and smooth operation. A good bitcoin platform improves the app's functionality and provides a better user experience.

Create A Design

Design is a key component of making DeFi apps. Create a design that is simple to understand and use, which will enhance the user experience. Pay attention to a clean layout, simple navigation, and features that look good.

Use wireframes and prototypes to illustrate the structure and functionality of the app. Ensure that the design fits with all planned features and provides users with a smooth experience. A well-designed app not only gets more users, but it's also easier for them to use, which makes them happier and more engaged.

DeFi App Development

Developing the DeFi app necessitates putting together the right set of technologies. Electron.js is best for PCs. The web uses Node.js for the backend and React.js for the frontend. You can make apps that work on both Android phone and iOS phones with React Native.

You should add blockchain, smart contracts, and key functions. Focus on writing clean, efficient, and secure code. Regularly test the development to ensure all components work well together. Make changes as needed to provide users with a smooth and effective experience.

Integrate Wallets

A wallet connection is necessary for your DeFi app to be able to handle digital assets. Integrate popular non-custodial wallets like MetaMask, Trust Wallet, or WalletConnect. Make sure the connection works smoothly so that users can safely and easily connect their wallets.

Wallet integration should support key functions such as storing, sending, and receiving cryptocurrencies. Giving users a safe and simple wallet experience builds trust and interest, which makes it easier for them to use your DeFi app.

Test DeFi App

Thorough testing is vital to ensuring your DeFi app functions correctly and securely. Perform full testing, which includes unit, integration, and end-to-end tests. Check smart contracts for bugs and performance issues. To be sure users have a smooth experience, test the usefulness of your site.

Get a wide range of tests to help you find problems that might happen on different devices and in other settings. Ensure your app remains robust, dependable, and ready for use by promptly resolving all identified issues.

Deploy DeFi App

Once testing is complete, deploy your DeFi app on the chosen blockchain platform. Verify the correct implementation of all components, including the smart contracts and backend services. Maintain the release process to identify and fix any issues as soon as possible.

After the app launches, maintain its speed and security, and resolve any problems you might find. Employ a variety of marketing methods to get people to download your app and help you build a strong group around your DeFi project.

How Much Does It Cost To Develop A DeFi App?

Creating a DeFi app can cost a lot, depending on its complexity, features, and the location of the development team. The cost can vary greatly. Creating a basic DeFi app can range from $$40,000 to $500,000 on average. The price can be more for complex apps with lots of features.

Some of the important cost factors include integrating Bitcoin, creating smart contracts, designing user interfaces, and testing. Ongoing maintenance, security audits, and following the rules can all contribute to the total cost. Engaging experienced developers and ensuring robust security measures are crucial for a successful and secure DeFi app.

Side Cost To Develop A Defi Apps

App Complexity

The complexity of a DeFi app significantly impacts development costs. Intelligent contracts with multiple layers, complicated financial processes, and complex user interfaces all cost more because they take more time and resources to build.

Costs are also higher for features such as real-time data analytics, advanced trading options, and custom algorithms. Making the app simpler can save money. Balancing simplicity and features to meet user needs and stay competitive is crucial.

Blockchain Network Selection

Choosing the right blockchain network may affect development and operational costs. Popular networks such as Ethereum may have higher transaction fees but provide strong protection and developer support. In contrast, fresher networks such as Binance Smart Chain or Polygon might have fewer established tools and resources.

It is important to examine network fees, scalability, and community support. The blockchain you choose should meet your app's needs and budget, while also providing the best speed and user experience.

Security Measures

Strong security measures are crucial for DeFi apps and can be a significant cost factor. Regular security checks, penetration tests, and smart contract verification are used to ensure safe user funds. Using sophisticated safety technology and encryption is important to keep hackers and fraudsters out.

Constant checks and updates of security steps increase the total cost. To maintain users' trust and prevent financial losses, it's important to spend money on full-security solutions. This is a necessary expense in DeFi app development.

Third-Party Integrations

Adding third-party services to a DeFi app makes it more useful but costs more. Integrations might include analytics tools, payment systems, and oracles for real-time data. Each connection requires customization, testing, and sometimes license fees, making the project challenging and costly.

It is important to ensure that various third-party services can work together effectively. This will help provide consumers with a seamless and valuable experience. The goal is to create a complete and useful experience for consumers.

This can be achieved by ensuring that different services can integrate and function well together. By carefully selecting and negotiating with third-party companies, we can manage and maximize these additional costs.

Geographical Considerations

Geographical factors, such as variations in labor rates and operational expenses across regions, can influence development costs. Developing in North America or Western Europe is more costly than in Eastern Europe or South Asia. This is due to the higher costs associated with expensive areas. In contrast, regions like Eastern Europe and South Asia tend to have lower development costs.

However, regional expertise and familiarity with local regulations may necessitate higher costs. Balancing cost and quality by considering developers’ knowledge and regional advantages can optimize your budget while ensuring a high-quality DeFi app.

Development Team Location

The location of your development team significantly impacts costs. Hiring developers in the US or Western Europe, where living costs are higher, typically results in higher compensation. Conversely, regions such as Eastern Europe, India, and Southeast Asia offer competent developers at more affordable rates.

However, differences in language, time zones, and cultural nuances can make it challenging to communicate and handle projects. When deciding where to place your DeFi app's team, consider cost, quality, and teamwork. It's crucial to find a good balance.

Defi App Development: Common Challenges and Solutions

Product Tokenomics

Creating a robust tokenomics model is essential for the success of a DeFi app. Tokenomics encompasses the design of the token's economic structure, including its distribution, utility, and user incentives. Finding the right balance between supply and demand is challenging because you want to make sure the token's value stays stable and appealing.

To fix this, developers should do market research, study successful tokenomics models, and add features that encourage long-term engagement. Working together with economists and blockchain experts can also help you make a tokenomics plan that works and lasts.

Performance Requirements

For the DeFi app to handle numerous transactions simultaneously without lag, it's necessary to offer strong performance. Performance issues can arise due to the decentralized nature of blockchain, which may lead to longer transaction handling times. Some options include improving the app architecture, using efficient algorithms, and utilizing layer-2 scaling solutions such as state channels and sidechains.

Regular speed testing and monitoring are necessary to identify and resolve bottlenecks. Also, making the app faster and more user-friendly by using caching techniques and improving the code for smart contracts.

Smart Contract Bugs

Smart contract bugs put the safety and usefulness of DeFi apps at great risk. These bugs can leave holes that hackers might exploit to steal information and large sums of money. Developers can reduce risk by following best practices. These practices include reviewing code, using verification methods, and conducting tests.

Tests that should be conducted include unit tests, integration tests, and security audits. Bug bounty programs can help find and report security issues in smart contracts, making them more secure.

APIs And Data Sources

For DeFi apps to function correctly, they need to utilize trusted APIs and data sources. This is because they need real-time data for things like price feeds and transaction validations. The challenging task is ensuring the information is accurate and reducing lag as much as possible. If developers want to lower the risk of manipulation or failure, they should choose decentralised data providers with a good reputation.

Using more than one data source to add duplication can make things more reliable. It's important to keep the app reliable by updating and checking APIs for performance and security issues regularly.

Why Do You Choose Technanosoft To Develop Your Innovative DeFi App?

Choosing Technanosoft to develop your DeFi app ensures a blend of expert knowledge, new ideas, and full help. Our team of experienced developers excels at blockchain technology, making safe DeFi apps flexible and easy to use. It presents custom, cutting-edge solutions developed to fulfill your needs. It ensures that the app has the newest features to maintain a competitive edge.

Technanosoft provides full support, from ideation to launch and beyond. It makes the development process easier and more successful with an innovative DeFi app.

FAQs About Decentralized Finance

Q.1- What are DeFi Platforms?

A- Defi definition: DeFi platforms, which stand for "decentralized finance platforms," allow financial transactions without traditional intermediaries like banks. They use smart contracts and blockchain technology to offer services like lending, borrowing money, trading, and earning interest.

Users maintain control of their assets and deal with other users directly, which promotes security, openness, and usability. Most of the time, these platforms function on decentralized networks like Ethereum. This allows all financial activities to be open globally and not subject to centralized control.

Q.2- What is the defi full form?

A- Defi meaning stands for decentralized finance. This word refers to a large group of financial services built on blockchain technology to offer an open alternative to standard banking systems. DeFi wants to make financial services more accessible and efficient by using decentralized networks and smart contracts instead of centralized institutions.

Q.3- What is DeFi Crypto?

A- DeFi crypto is a term for cryptocurrencies used within decentralised finance ecosystems. On DeFi platforms, these digital assets make it easier to perform many financial things, such as lending, borrowing, trading, and creating interest. Common DeFi coins are Ether (ETH) on Ethereum blockchain and other tokens made for smart contracts. DeFi crypto assets make it possible for financial deals to be smooth, safe, and decentralised.

Q.4- What Does Decentralization Mean?

A- Decentralization is when authority and control are spread out instead of being concentrated in one place. When it comes to blockchain and DeFi, "decentralization" means that a single authority does not control the network. InsteaInstead, a distributed network of computers known as "nodes" handles operations and transactions. akes things safer, more open, and less likely to fail in a single place.