SoFi - Banking and Investing App Development Cost

In today's fast-evolving financial world, neobanking apps like sofi capacity are revolutionizing how we manage our money. These innovative FinTech companies are changing traditional banking by focusing on convenience and transparency. Neobanks provide many services, such as loans, investing, payments, and transfers, all of which you can access through your smartphone. It makes managing your money more accessible and natural than ever before.

Neobanks like Chime, Monzo, and Revolut are also making waves, besides SoFi. These digital-first banks are changing the financial landscape by offering simple, low-cost services and smart tools for managing money designed to meet modern customers' needs. Neobanks are good for people who are good with technology and want more features in their sofi mobile banking. These features include budgeting tools, no fees for foreign transactions, and instant spending alerts.

This blog post will explore how a neobanking sofi bank app works, including its costs, key features, development steps, and how it makes money. If you're an aspiring entrepreneur interested in technology or just wondering about modern banking, this exploration will help you.

What is Sofi App?

The SoFi app is a flexible financial tool to help users manage their finances. It offers a range of loans, like personal loans, housing loans, and refinancing student loans. SoFi lets users trade stocks and cryptocurrencies, and offers a robo-advisor service for automatic investing. A good investment option.

The app has a cash management account that lets you use ATMs for free and earn decent interest rates. sofi capacity to simplify financial management by giving users an easy-to-use interface and educational materials. This will make it easier for users to save, spend, and reach their financial goals.

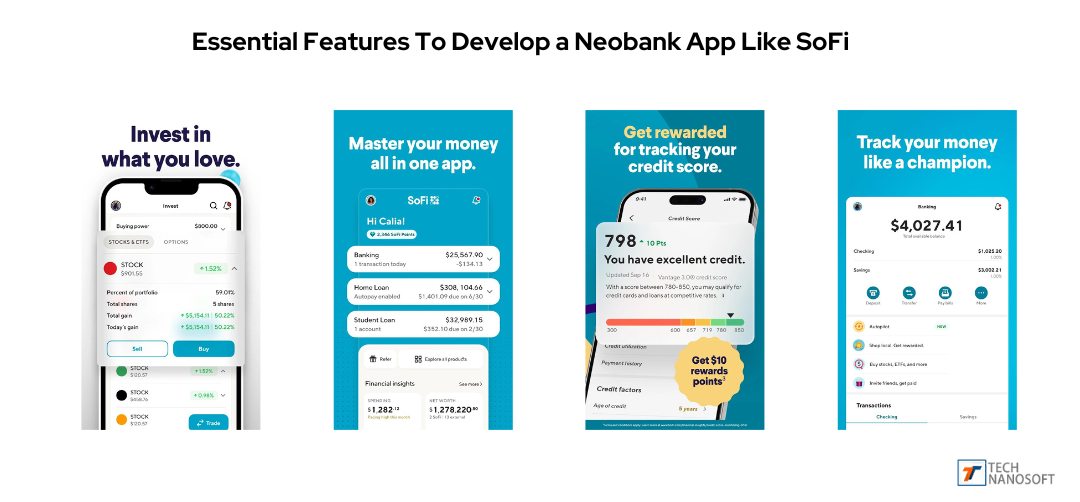

Essential Features To Develop A Neobanking App Like SoFi

Advanced Features:

SoFi Money

SoFi Money is a cash management account that allows users to do no-fee banking with high interest rates. It combines the benefits of both cash and savings accounts into a single account. You can quickly get to your money with a debit card and use any ATM for free.

The account offers overdraft protection and seamless integration with other SoFi products. Users can also get cashback awards and automated savings tools. With a focus on user ease and financial health, SoFi Money ensures that sofi mobile banking is easy and cheap and doesn't charge fees like traditional banks.

SoFi Relay

SoFi Relay is a tool for managing money that helps users track their credit score, spending, and debt in one place. It offers real-time financial information that helps them better understand their financial health. SoFi Relay gives users tools to make informed decisions by allowing spending analyzing and financial goal setting.

The tool also lets users know when their credit score or sofi stock buy or sell habits change in a big way, which helps them keep track of their money. SoFi Relay strives to simplify money management and enhance users' financial well-being.

SoFi Protect

SoFi Protect offers various insurance products to safeguard users' financial futures. It provides many coverage options, including life, auto, and homeowners insurance. The service aims to offer affordable prices and customizable policies to cater to individual preferences. The sofi bank app makes it simple for users to compare insurance quotes and buy plans.

SoFi Protect also gives users personalized help and tips to ensure they choose the proper coverage. This function helps users protect their property and loved ones, which makes their finances safer overall.

SoFi Invest

SoFi Invest provides a range of investment options, including sofi stocks, ETFs, and cryptocurrency trading. The platform also offers automated investing via its robo-advisor service. This service builds and runs a diversified portfolio based on the user's risk tolerance and financial goals. With low prices and no account minimums, SoFi Invest makes investing easy for everyone.

The sofi bank app also gives users access to learning materials and market information to help them make smart financial choices. Investing should be easy with SoFi Invest, which helps people get rich over time.

Financial Planning and Career Coaching

SoFi offers personalized financial planning and career coaching services to help users achieve their economic and professional goals. Financial planners help tailor advice on budgeting, saving, and investing. Career coaches guide job searches, resume building, and career transitions.

These services aim to help people at all stages of their career and financial lives. As well as giving users personalized support and expert advice, SoFi helps users make smart choices about their money and jobs.

Financial Dashboards

Financial dashboards within the SoFi app provide users with a comprehensive overview of their financial situation. These dashboards show key metrics like account balances, spending patterns, investment success, and debt levels. It's easier to keep track of progress toward financial goals when users can change their screens to show only the most essential information.

Users can quickly understand their financial health and identify areas for improvement through the visual display of data. Financial screens are necessary for planning and managing money effectively.

All Currency Support

All-Currency Support ensures that users can easily handle and make transactions in multiple currencies. This function primarily benefits users who travel to or do business with other countries. The sofi mobile app allows users to hold, trade, and send money in various currencies while also providing real-time exchange rates.

It allows users to get the best exchange rates and avoid expensive fees when dealing with foreign currencies. All Currency Support makes the sofi bank app more valuable and appealing to people worldwide.

Voice-Activated Assistance

Speech-activated assistance lets users access their financial accounts hands-free using speech recognition AI technology. Users perform tasks such as checking account balances, transferring funds, and getting financial advice using voice commands.

This feature makes it easier for users to reach and manage their finances while on the go. Voice-activated aid works in multiple languages to help a wide range of people. It is the next step toward making managing money easier to understand and use.

Education Resources

SoFi provides many educational resources to help students learn more about money. Some of these tools include articles, webinars, and tutorials about budgeting, investing, and planning for retirement. The sofi mobile app also provides users with market research and insights to keep them updated on changes and trends in the financial world.

SoFi helps users make informed financial decisions and improve their general financial health by offering helpful information. As part of its goal to promote financial well-being, SoFi provides a lot of educational resources.

Investment Education

Investment education is a crucial feature that helps users understand the complexities of investing. SoFi offers users guides, webinars, and tools to learn about its investment options and strategies. The sofi app provides users with personalized investment tips and information about the market to help them make intelligent choices.

SoFi wants to make investing easier and less scary for everyone by taking the mystery out of the process and offering ongoing help. Learning about investments gives people the ability to build and manage wealth effectively.

Basic Features:

Mortgages

A Neobank app like SoFi should offer a service that allows users to apply for home loans right from the app. This feature has competitive interest rates, several loan choices, and an easy application process.

Users can get personalized advice, pre-approval tools, and mortgage apps to help them make smart choices. The sofi mobile app helps users buy a home by guiding them through the entire process. It starts with applying for a mortgage and ends with closing on the property.

Strong Customer Support

Strong customer support is essential for a Neobank app, ensuring users receive timely and practical assistance. This feature includes 24/7 availability through multiple chat, email, and phone channels. The sofi app should have a full help center with many tips and FAQs.

Knowledgeable representatives can quickly and easily solve problems with personalized help. Good customer service is important because it helps users feel valued and confident in managing their money.

Loan Refinancing

The loan refinancing options in the Neobank app help users combine and better handle their debt. This feature provides access to student loans, personal loans, and mortgages at competitive rates. Users can easily apply for refinancing through the sofi mobile app. This can simplify the process and potentially reduce their interest rates and monthly payments.

Users can learn about their refinancing options and make smart choices with the help of loan tools and personalized advice. Giving people the option to refinance their loans can improve their finances and savings.

Trading and Investment Options

Neobank apps with Trading and investment options allow users to grow their wealth through a variety of investment opportunities. This feature gives you access to sofi stocks, ETFs, cryptocurrencies, and tools for managing your account and analyzing the market. Real-time trading, low fees, and training tools to help users learn more about investing are all benefits.

Users can tailor their portfolios to their financial goals and risk tolerance with the help of robo-advisors and other automated investing options. This all-around approach to investing helps people make money in the long run.

Mobile Cheque Deposits

Mobile check deposits allow users to deposit checks quickly and conveniently using their smartphone camera. This feature should have a simple interface, strong encryption, and quick processing times. A user can deposit a check by taking a picture, checking the information, and sending it in.

Mobile check payments make banking easier by allowing people to handle their money from anywhere without any problems. For a fully digital banking experience, this function is a must.

Payment System Integration

Payment system integration ensures that users can make and receive payments effortlessly through various platforms. This feature should support integrations with well-known payment methods like Apple Pay, PayPal, and Venmo. It should also be able to handle straight bank transfers and bill payments.

Users can keep track of all their transactions, set up recurring payments, and view a log of all their payments in one place. Secure and smooth payment integration makes it easier for users to handle daily transfers and expenses. It also makes financial management easier.

Cashback and Rewards Programs

Cashback and rewards programs incentivize users to engage with the Nedbank app by offering financial benefits. Users who use their debit or credit cards can get cashback on purchases and earn reward points for doing different things. You can exchange these awards for cash, deals, or other benefits.

The app should make it easy to keep track of rewards won and give personalized tips on how to get the most out of them. Cashback and award programs make users happier and more loyal, which makes them more likely to keep using the sofi app services.

Real-Time Notifications

Real-time notifications keep users informed about their account activities and financial status. This feature provides instant alerts for transactions, low balances, payment due dates, and activities that seem fishy. Users can change the settings for notifications to get information on specific events and at certain times.

Real-time alerts make things safer, keep people on top of their money, and keep them from getting late fees or bank fees. This tool ensures that users always know what's going on with their money and can act immediately.

Accurate Financial Advice

A critical part of a Neobank app is accurate financial advice, which helps users make smart choices about their money. Based on the user's financial information and goals, the app should give them unique financial advice, budgeting tips, and trade suggestions. Users can get help from financial experts and automated advice tools for saving, investing, and managing debt. People can reach their financial goals and improve their general well-being if they get sound financial advice.

Budget and Financial Planning Tools

Budget and financial planning tools help people manage their money better by showing them how much they earn, spend, and save. These tools should have budgeting, tracking, and making goals features that can be changed to fit your needs. Users can get information and suggestions on how to spend their money more wisely and reach their financial goals.

The sofi app helps users track their spending and make decisions using detailed reports and graphs based on data. Tools for creating a budget and planning your finances are essential for encouraging financial control and growth.

Seamless Account Management

A Neobank app needs smooth account management so users can easily access their financial accounts from one place. This feature includes account opening, closing, and management functions, allowing users to update personal information, view transaction history, and transfer funds effortlessly. The app works better when connected to external accounts and banking services. An easy-to-use interface makes it simple and quick to manage accounts, leading to a favorable user experience and financial control.

Credit and Loan Services

Users can access various types of loans and credit services in a Neobank app. These include personal loans, credit cards, and lines of credit. This feature should offer competitive interest rates, flexible payment terms, and a simple application process. Credit score monitors and loan calculators tools that can help users make informed borrowing decisions.

Users can choose the best credit and loan choices for their needs with the help of clear terms and personalized suggestions. This helps them reach their financial goals and improves their credit health.

How To Develop a Neobanking App Like SoFi

Market Research

Market research is the first step in developing a Neobank app. It involves analyzing the current state of the financial market, picking out target audiences, and getting to know their wants and needs. Researching competitors like SoFi can help you identify good tactics and market gaps.

This method helps developers make special features that attract users by using data and creating a unique value proposition. Market research helps the app meet user needs and stand out in a crowded market, paving the way for future growth.

Objectives and Goals

Setting clear objectives and goals guides the Neobank app development process. The app primarily aims to provide seamless digital sofi mobile banking services or offer personalized financial advice. Goals list specific, measurable goals, such as the number of new users, the rate of engagement, or a certain amount of revenue.

These goals keep the project on track and show how far along it is. Setting clear objectives and goals helps the development team work together to ensure the end product meets the needs of both the business and the users.

Neobank App Development

Creating the Neobank app involves designing and building key features like user registration, account management, and financial transactions. This stage includes creating an easy-to-use interface. It also involves ensuring that budgeting tools, loan services, and investment options are all functioning properly.

Developers must consider security steps that keep user data safe and follow financial rules. Using agile development methods can speed up the process and allow you to try and make changes multiple times. Development transforms the idea for an app into a functional, user-ready product.

Payment Integration

Payment integration is an integral part of making Neobank apps because it lets users safely make purchases inside the apps. This requires the integration of payment gateways and platforms such as Apple Pay, PayPal, and Stripe. Standard banking networks must also allow for direct bank transfers. Ensuring the app works with various payment methods makes it easier for users and more valuable.

To keep private financial data safe, developers must put security measures like encryption and tokenization at the top of their list of priorities. When payment integration goes well, transactions go smoothly and reliably, which builds trust and customer happiness.

Neobank App Testing

Testing the Neobank app is critical to identifying and fixing any issues prior to launch. This involves rigorous testing of features like functionality, security, and speed. Usability testing ensures the app is simple to understand and use, and security testing ensures that the steps taken to protect data are effective. Load testing checks how well the app works in different situations.

Beta testing with a small group of people gives useful feedback and helps you find ways to improve things. Testing the app thoroughly ensures it works well, meets user needs, and follows industry standards.

App Deployment

App deployment is the process of launching the Neobank app. To do this, you need to submit the app to both the Apple App Store and Google Play Store. You also need to make sure that the app follows all the rules for submission.

A good marketing plan is important for a successful launch. It includes promotions, press releases, and engaging with users.

After the app goes live, monitoring it to find any problems and get user comments is important. A smooth launch into the market and high user adoption depend on an effective rollout.

Future Services: Maintenance and Updates

Maintenance and updates are vital for the long-term success of a Neobank app. Regular maintenance ensures that the app remains safe, bug-free, and compatible with new working systems. Updates add new features, improve old ones, and consider what users have said.

It's important to offer ongoing customer support to fix problems and keep customers happy. By changing the market and constantly improving the Neobank app, developers can keep it current, competitive, and able to meet user needs.

READ ALSO- GoPuff On-Demand Alcohol Delivery App Development Cost

Side Cost To Build A Neobank App Like SoFi

Third-Party Integration

Third-party integration costs arise when incorporating external services like payment gateways, fraud detection, and name verification. You have to pay third-party integration costs. Adding integrations to the app can make it more valuable and secure.

However, this often comes with extra costs. These sofi cost to build may include subscriptions, licensing fees, and development time.

It is essential to choose dependable third-party companies to ensure everything runs smoothly and meets industry standards. Finding the right balance between the costs and benefits of integration can greatly affect the Neobank app's total budget and quality.

App Complexity

App complexity significantly influences development costs. Making a Neobank app with advanced features like real-time messages, AI-driven financial advice, and support for multiple currencies takes more time and money. Complexity also increases the complexity of testing and maintenance.

Keeping the app's first version simple and adding features slowly can help keep costs down and make the development process go more smoothly. However, maintaining a balance between necessary functions and what users want is crucial for the app's success.

App Platforms

Developing a Neobank app for iOS operating system and Android operating system can be costly. This is because it involves creating and testing the app separately for each platform. Cross-platform development tools allow the reuse of code across systems, which can save you money.

However, it's crucial to guarantee platform-specific enhancements and maintain a consistent user experience across all devices. Picking which platforms to focus on first can help you keep your budget in check and reach your target group effectively.

Cloud Services

Cloud services provide scalable infrastructure for hosting and managing the Neobank app. The cost of cloud services depends on data storage, server capacity, and usage frequency. Major providers like AWS, Google Cloud, and Azure offer various pricing models, including pay-as-you-go and subscription plans.

Using cloud services guarantees dependability, security, and adaptability, but coders must carefully guess how much they will be used to keep costs down. If you manage the cloud well, you can improve performance and reduce costs.

App Design

App design costs include creating an easy-to-use, visually appealing user interface and experience. Hiring professional UI/UX designers ensures the app is easy for people to use and meets standards in the industry.

The costs include wireframing, prototyping, and testing the idea with users in order to improve it. Good design is important for retaining users and affecting the app's success. To make a fun and useful Neobank app, you need to find a good balance between design costs and usefulness.

Development Team Location

The development team's location has a significant impact on costs. Hiring developers in regions with lower living sofi cost to build, such as Eastern Europe or Asia, can reduce expenses compared to teams based in North America or Western Europe. But it's important to think about the quality and experience of the team.

Finding a good balance between cutting costs and acquiring the necessary expertise to create a complex Neobank app ensures a high-quality final result. For success, you need to be able to communicate and handle projects well.

Tech Stack

The choice of tech stack impacts both sofi cost to build and the app’s performance. Select suitable computer languages, frameworks, and tools to make a safe, scalable, and effective Neobank app. License fees, developer assistance, and long-term upkeep are all costs.

A good tech stack can speed up development and reduce costs while keeping the app open to meet future needs. It is essential for sustainable growth to find a balance between short-term costs and long-term benefits.

Hosting

Hosting costs cover the expenses of running the app on servers and making sure it is accessible to users. These prices change based on the server provider, the amount of traffic, and the required performance standards. You need hosting services you can rely on for uptime, speed, and security.

Choosing an exemplary hosting service and plan can help you save money while ensuring the app works well and is reliable. Monitoring and making growing changes on a regular basis help keep hosting costs under control.

Revenue Model: Neobanking App Like SoFi

Origination Loan Fees

The Neobank app charges origination loan fees when users take out new loans. These fees cover handling loan applications, checking credit, and running the business. Typically, the neobank pays a portion of the loan amount upfront or bundles them into the loan. Origination fees give the neobank a steady way to make money, especially as it grows and adds more loans to its collection.

Interest Income

Lending to other users and charging interest on the borrowed amount generates interest income. Personal loans, mortgages, and other credit goods can be accessed through the Neobank app. We set the interest rates based on the borrower's reputation and the market conditions. Neobanks need this way of making money because it keeps the money coming in and gives people the sofi mobile banking services they need.

Investment Product Fees

Investment product fees are charged to manage and maintain users' portfolios in good shape. This includes fees for robo-advisory services, sofi stock buy or sell, and cryptocurrency usage. You can structure these fees as a flat transaction fee or as a percentage of the managed funds. By giving users various investment choices, the Neobank app can get more users and make more money from investment-related services.

Membership Fees

Membership fees are charged to users who subscribe to premium services or exclusive features within the Neobank app. These fees can be monthly or once a year, but they come with perks like higher interest rates on savings accounts, lower interest rates on loans, or extra financial tools. Membership fees are a reliable way to make money, and paid services that give users more value make them more loyal.

Interchange Fees

Interchange fees are earned when users purchase their neobank-issued debit or credit cards. Merchants pay these fees to the Neobank so that it can handle card payments. The amount changes based on the purchase size and the merchant's deal terms with the payment network. As the number of users and card usage rises, more money comes in from interchange fees.

Collaboration Fees

Collaboration fees can be earned with other banks, fintech companies, or service providers. The Neobank app earns these fees when it integrates third-party services such as insurance, budgeting tools, or trip rewards. Collaborations improve the app and give you more ways to make money by sharing income or referral fees. This model encourages new ideas and grows the app's environment.

Innovative Approach With Technanosoft To Develop A Neobanking SoFi App

Technanosoft employs an innovative development technique to make a SoFi neobank app. Starting with a complete market analysis to find trends, customer wants, and gaps in the market. They apply the agile development method, ensuring they are flexible and efficient using iterative sprints and always getting feedback. By combining cutting-edge technologies like AI and blockchain, Technanosoft improves privacy, customization, and the speed of operations.

Their design is focused on making tools easy to use and experiences that are smooth for users. Intense testing stages also ensure that the app works well and is reliable. This innovative, all-around method guarantees the creation of a neobank app with many features.

FAQs About SoFi App

Q.1- What are the drawbacks to SoFi?

A- One problem with SoFi is that it doesn't have many natural branches, which could be a problem for people who like to bank in person. Some services may also charge more than standard banks for certain things. SoFi has many goods, but since it's still pretty new, it might not have the reputation of well-known banks.

Q.2- What are the pros of SoFi?

A- SoFi has many great features, such as no account fees, low interest rates, and a wide range of banking services. Users like tools for financial planning, changing loans and making investments. The app's easy-to-use design and excellent customer service make it more convenient and enjoyable.

Q.3- What is the minimum balance for SoFi?

A- In order to use its cash management accounts, SoFi does not require a minimum amount. This means that people with all kinds of financial situations can use it and enjoy SoFi's services without worrying about keeping a certain amount of money in their accounts.

Q.4- How many users are on SoFi?

A- As of today, more than 4 million people are using SoFi. This growing number of users shows how popular and trusted the app is among consumers drawn to its wide range of financial goods and focus on the customer. SoFi keeps growing because it wants to change how people handle their money.