AI in Banking- How Artificial Intelligence Reshaping Banking

The AI Revolution has a significant impact on businesses, particularly in banking and artificial intelligence in finance. It has changed how they operate and provide services to customers. AI in banking apps has improved customer focus and kept the industry current with new technology.

AI-based systems are helping banks to reduce costs with making them more productive and data base decission making. Additionally, smart programs can quickly spot information that isn't real.

According to Business Insider, nearly 80% of banks recognise the potential benefits of AI in banking. McKinsey's other study says that AI could be worth as much as $1 trillion in banking and finance. The banking and finance industry is moving quickly toward AI to cut costs, improve service, and boost productivity.

This blog post will discuss the key applications of AI in finance and banking sectors. Also discussed will be how this technology is changing the customer experience with its many benefits.

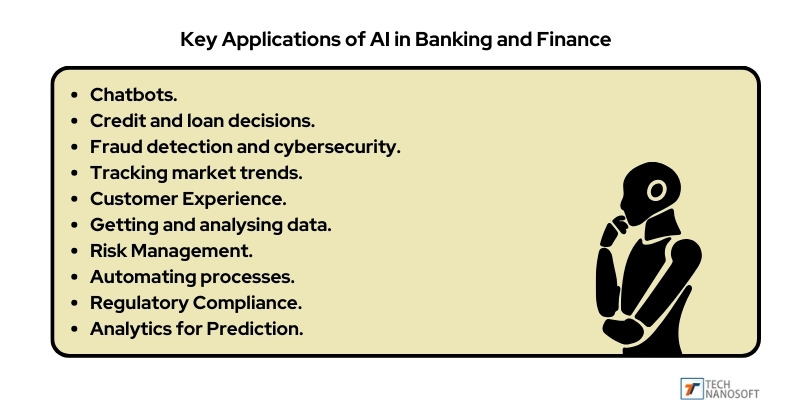

Key Applications of AI in Banking and Finance

Chatbots

Chatbots are changing customer service in the banking industry by providing instant, 24/7 support. Unlike human workers, who have set hours, AI-powered chatbots are always available. They can help with a wide range of banking needs at any time. These smart bots can learn from how customers interact, which lets them provide personalised services and suggestions.

A chatbot helps customers by checking account balances, transactions, and answering common questions. Customers don't have to wait for a person to help them. Chatbots help by answering easy questions, allowing human agents to focus on harder issues. This makes banking faster and keeps customers satisfied.

Credit and Loan Decisions

AI is changing loan and credit decision-making processes in banks. Traditional methods rely on credit scores and past data but often miss important information. AI systems analyse past transactions, buying habits, and social behaviour to better understand someone's creditworthiness. These systems identify potential challenges and predict the likelihood of failure more accurately.

AI-run credit checks also reduce errors and bias, resulting in more equitable choices. Banks can speed up loan approvals and provide customized credit options by automating and enhancing the process. This will improve customer satisfaction and streamline operations.

Fraud Detection and Cybersecurity

Since digital banking came along, security and finding scams have become extremely important. Cybercriminals love banks because they handle so many online activities every day. AI steps in to improve security, as measured by constantly watching activities for trends that might point to fraud.

Machine learning systems look at vast amounts of data all the time, finding oddities and stopping breaches before they happen. AI can detect unusual spending patterns or multiple failed login attempts, triggering alerts and automatic responses. This proactive method keeps private data safe and builds customer trust, ensuring the banking environment is secure.

Tracking Market Trends

The Artificial intelligence and ML are invaluable tools banks that want to track market trends in the banking sector. AI in banking can identify new trends and give useful information for investment plans by processing massive datasets. These complex systems look at how people feel about the market, past data, and financial news to guess how it might move.

AI can help banks and clients make smart investment choices by suggesting the best times to buy or sell stocks. AI can analyze market trends quickly and accurately. This helps people make better decisions. It also helps banks stay competitive in the fast-paced financial world.

Customer Experience

AI elevates the customer experience in the banking sector by offering convenience and efficiency. AI-driven solutions meet the needs of current customers who want quick and easy services. They do this by automating account setup and giving personalised financial advice.

For example, AI can speed up the Know Your Customer (KYC) process by collecting and verifying client information more correctly. This reduces the time and errors required for on boarding.

AI systems can suggest products and financial deals tailored to each customer preferences. This personalised approach makes customers happier and more loyal because they enjoy getting help from their banks when needed.

Getting and Analysing Data

Every day, millions of activities generate massive amounts of data. Collecting, organising, and analysing data efficiently is important so that processes run smoothly and decisions are well-informed. AI speeds up these steps by automating jobs that involve handling data. This cuts down on mistakes and makes sure that records are correct.

Advanced ai in banking algorithms can sift through vast datasets, extracting valuable insights for decision-making and identifying potential scams. For instance, AI can identify patterns in individuals' financial spending or unusual activities that require further investigation.

This feature makes operations run smoothly. It enhances the customer experience. It allows you to offer personalized services. It also helps you take proactive security measures.

Risk Management

Risk management is crucial for banks, especially with the unpredictable nature of global markets. AI improves this by giving us deep insights through advanced analytics. AI in banking systems can predict risks and suggest ways to reduce them by analyzing past data, market conditions, and customer behavior.

AI can predict changes in the economy. This helps banks prepare for fluctuations in the value of the dollar. It also helps them anticipate decreases in the stock market. AI can also predict a borrower's lack of loan repayment by analysing their finances.

This proactive method enables banks to make smart choices that keep losses to a minimum and keep things stable even when the economy is unstable.

Automating Processes

AI-powered robotic process automation (RPA) is revolutionising operational efficiency in bank work by automating routine, repetitive tasks. Tasks like entering data, handling transactions, and checking for compliance take much time and are prone to mistakes. AI-powered RPA systems can do tasks quickly and accurately, allowing humans to focus on more complex and strategic tasks.

For example, JPMorgan Chase's CoiN technology uses AI to read through legal papers and pull out important information quickly. This technology not only increases speed and accuracy but also cuts costs by a significant amount, which makes banking processes run more smoothly.

Regulatory Compliance

Complying with regulations in banking is difficult because the rules are always changing. It's important to stay informed and pay attention to details. AI helps banks by automatically tracking and analyzing regulation changes.

Machine learning and Natural Language Processing programs can help banks understand new rules. These programs ensure that policies and procedures are current. They analyze the meaning of the rules to provide clarity.

AI also make it easier to create compliance reports, which saves time and effort that would have been used for human checks. AI in banking can't completely replace human researchers, but it makes them much more efficient and accurate, which helps banks stay in line with changing rules and avoid expensive fines.

Analytics For Prediction

AI-powered predictive analytics is changing the banking industry by giving it a level of vision that traditional methods cannot match. By analysing past data and identifying patterns, AI can predict future trends and find patterns. Predictive analytics can forecast loan failure, helping banks prevent it before it occurs.

It can also find chances to cross-sell other financial goods, which can help increase revenue. This technology helps banks make better decisions by providing them with data-driven insights. It helps banks improve their risk management and customer engagement. Predictive analytics will enable banks to anticipate and respond effectively to market dynamics.

Real-World Examples of AI in Banking

JPMorgan Chase

Regarding AI in the banking business, JPMorgan Chase is at the forefront. Scientists made a new warning system. The system uses AI and deep learning. It can detect cyber threats like malware, trojans, and phishing attacks.

This system monitors vast data and finds odd behaviour, promptly alerting the bank's cybersecurity team. This approach halts threats before they can cause significant damage. This method helps keep the bank and customer data safe, improving the banking environment and maintaining trust.

Capital One

Capital One's intelligent virtual assistant, Eno, has integrated AI into its operations. Eno offers personalised banking services like checking your amount, alerting transactions, and even virtual card numbers for safe online shopping. This AI-driven customer interaction entails answering questions quickly and correctly, resulting in higher total customer satisfaction.

Capital One also uses AI's creative computing power to develop new ways to stop scams and keep customers interested. These projects show how AI can be used in the banking industry to improve security, speed up processes, and give excellent customer service.

The European Bank

Technanosoft partnered with a major European bank to set up an AI-based chatbot that improved customer service. This chatbot helps customers with issues like lost credit cards and account requests in different languages, making problem-solving easier.

After automating these conversations, the bank retained 20% more customers. The chatbot can answer hard questions, making customer service better and banking easier for everyone. AI helps reduce wait times and improve efficiency in banking services globally.

READ ALSO- How is AI in Education Revolutionizing Industries?

Challenges in Adopting AI and ML in Banking

Data Security

Data security is one of the biggest problems with using AI and ML in banks. Banks handle enormous amounts of sensitive customer information, making them prime cyberattack targets. Ensuring proper protection of this information is crucial. AI can assist by using advanced encryption methods and real-time tracking systems to find and fix security holes.

Banks should choose technology partners who understand AI and banking complexities and can offer strong security solutions. Banks can protect customer information, follow the rules, and build trust in AI-powered services by prioritising data security.

Lack of Quality Data

The data quality used to train AI systems heavily influences their performance. Banks often struggle with unstructured or incomplete data, leading to inaccurate predictions and decisions. Ensuring data is clean, organised, and complete for AI solutions to work is important. Banks need to invest money in systems that can quickly process and organise data.

They must also set up strict data governance rules to keep the data correct and honest. Banks can improve their AI systems by addressing these issues. This will help them detect fraud more effectively. It will also enhance customer service and improve risk management.

Lack of Explainability

One significant challenge with AI systems in banks is their lack of explainability. AI models and intense learning systems work like "black boxes," making it hard to determine how they make decisions. It is challenging for stakeholders to trust choices they can't understand, so this lack of clarity can happen.

Banks should use AI models with built-in openness features to get around this. This would ensure that the decision-making process is clear and logical. Giving clear reasons for AI-driven decisions helps maintain trust and accountability, which is crucial for integrating AI into banking processes.

JPMorgan Chase

JPMorgan Chase is at the forefront of AI innovation in the banking industry. Bank researchers created a new early warning system. The system uses AI and deep learning technology. It can identify cyber threats like malware, trojans, and phishing attacks.

This system monitors vast amounts of data and finds odd behaviour, promptly alerting the bank's hacking team. This prevents threats from causing significant damage. This proactive method keeps the bank's infrastructure and customer data secure, making banking safe and building trust.

Capital One

Capital One's intelligent virtual assistant, Eno, has integrated AI into its operations. Eno offers personalised banking services like balance inquiries, transaction alerts, and virtual card numbers for secure online shopping. This AI-driven assistant improves customer interactions by answering questions quickly and correctly, increasing customer satisfaction.

Capital One also uses AI's creative computing power to develop new ways to stop scams and keep customers interested. These projects show how AI can be used in the banking industry to improve security, speed up processes, and give excellent customer service.

European Bank

Technanosoft worked with a central European bank to set up an AI-based robot that significantly improved customer service. This chatbot, which could answer real-time customer questions in multiple languages, made it easier to handle problems like lost credit cards and account requests.

After automating these conversations, the bank retained 20% more customers. The chatbot can answer complex questions, demonstrating how AI can enhance customer service. It also helps reduce wait times and simplifies banking for people globally.

How AI and Machine Learning Complex To Use In Banking?

Safety of Data

Keeping data safe is one of the biggest problems with using AI and ML in banks. Cyberattackers love banks because they have a lot of private customer data that they need to keep safe. It is essential to make sure that this information is adequately protected. AI can assist by using advanced encryption methods and real-time tracking systems to find and fix security holes.

But banks also need to pick technology partners that know how AI and banking work together and can offer robust security options. Banks can protect customer information, follow the rules, and build trust in AI-powered services by prioritising data security.

Lack of Quality Data

The data quality used to train AI systems extensively influences their effectiveness. Banks often struggle with unstructured or incomplete data, leading to inaccurate predictions and decisions. Ensuring the data is clean, organised, and complete for AI solutions to work is important. Banks need to spend money on systems that can quickly process and organise data.

They must also set up strict data governance rules to keep the data correct and honest. Take care of these problems, and banks will be able to get better results from their AI systems in areas like fraud spotting, customer service, and risk management.

Lack of Explainability

One significant challenge with AI systems in banks is that they are hard to understand. Most of the time, AI models and intense learning systems work like "black boxes," which makes it hard to figure out how they make decisions. Stakeholders must trust choices they can't understand, so this lack of clarity can happen.

Banks should use AI models with built-in openness features to get around this. This would ensure that the decision-making process is clear and logical. Providing clear explanations for AI decisions is crucial for building trust and accountability when using AI in banking operations.

Steps To Become an AI-First Bank

Develop an AI Strategy

Developing a comprehensive AI strategy is the first step for banks aiming to integrate AI into their operations. This strategy should fit with the bank's main goals and principles. It includes conducting internal market research to find gaps that AI can fill and ensuring that the company follows all industry rules and standards.

To make it simple for people to use AI, the plan should also cover things like talent, data infrastructure, and algorithm policies. Banks may create a plan for integrating AI technologies by developing a solid AI strategy. They can ensure consistency and maximise AI use in all functional units this way.

Plan a Use Case-Driven Process

Identifying high-value AI opportunities is a critical component of successful AI implementation. Banks should choose projects that match their goals and methods, and check if they are possible and effective. This needs a lot of testing and gap analyzing to select the most promising applications.

Mapping out the necessary AI talent through in-house development or external partnerships is essential to support these efforts. Banks can ensure that their AI investments are targeted and valuable by planning a process based on use cases. This will lead to fundamental changes in operations and customer service.

Develop and Deploy

Prototypes are made to see if the technology can work when developing and deploying AI solutions. Banks train AI models to ensure their reliability. Putting these models to the test in real-life situations helps find and fix any problems.

Once the models improve, they can use accurate data and continue to improve over time. This repeated process ensures that AI solutions are strong, effective, and able to achieve their goals. It is possible for banks to achieve significant enhancements in operational efficiency and customer satisfaction.

Operate and Monitor

AI systems need continuous monitoring and calibration, which is essential to maintaining their effectiveness. Banks should regularly review AI models to make sure they are meeting business goals and security standards.

The models remain accurate and reliable by making regular changes and improvements based on new data. This proactive approach to maintenance and tracking makes sure that AI solutions stay helpful, safe, and in line with the bank's changing requirements. By carefully managing and monitoring AI systems, banks can maximise the benefits of AI while mitigating risks and issues.

Why Banks Need to Embrace AI in Banking Now?

The banking sector is undergoing a specific transformation, transitioning from a people-centric approach to a customer-centric one. AI is important for banks to meet customer needs for constant service and fast, simple processes in the modern era. Using AI allows banks to overcome internal challenges, such as outdated legacy systems, data silos, and limited budgets.

AI-powered solutions make things run more smoothly, cut costs, and improve customer experience. AI can automate routines, give you personalised financial advice, and help you handle risks better. By using AI, banks can stay ahead of the competition, keep coming up with new ideas, and give their users better services that meet their changing needs.

The Generative AI Impact

Generative AI offers transformative solutions in banks by analysing and gathering vast data. This technology helps people make better decisions, reduces operational risks, and improves predictive analytics. Generative AI can make realistic synthetic data for training models, keeping privacy while maintaining accuracy.

It also automates making financial reports, regulatory papers, and customer communications, making things much more efficient. Generative AI adapts to changing transaction trends to detect fraud, strengthening security. Banks can use tools to make their processes smoother, involve customers more, and manage risks better. This creates a safer and more efficient banking environment.

How Technanosoft Can Assist Your AI-Powered Banking Journey?

Technanosoft, a leading AI services company, offers tailored solutions for banks and other financial institutions. With expertise in AI and ML, Technanosoft creates custom models that increase income, lower costs, and lower risks. Their IT consulting services assist banks with specific issues by utilizing AI to manage risks, streamline operations, and enhance customer satisfaction.

The experts at Technanosoft help banks develop and implement long-term AI plans that are both new and in line with best practices in the industry. Banks working with Technanosoft use cutting-edge AI technologies to make significant changes and reach their strategic goals.

FAQs

Q.1- How does AI help in banking?

A- AI assists banks by automating tasks, improving customer service with chatbots, detecting fraud, optimizing investment strategies, and predicting market trends. For instance, AI can look at customer transactions to find odd behaviour, which makes scam detection extremely accurate. They quickly answer questions and make customers happier.

AI algorithms can also look through vast amounts of data to give you personalised investment tips and guess how the stock market will move. Banks using AI can boost productivity, lower operational costs, and give their users better, more personalised service.

Q.2- What role does AI play in managing risk in banks?

A- The role of artificial intelligence in banking management and looking at large amounts of data to adress trends and possible risks. It lets you watch deals in real time and quickly spot problems or fraud. AI systems can ensure adherence to rules by automatically monitoring deals and generating the required reports.

One AI skill is predictive analytics. This involves using past and behavioral data. It helps banks predict the likelihood of defaults and market volatility occurring. Banks use risk assessments to make smart decisions and reduce potential risks, which helps keep the economy stable during uncertain times.

Q.3- What are the most important AI trends in banks right now?

A- The most significant AI trends in banking are as follows:

1. AI-powered chatbots: enhance customer service by providing more individualised assistance and promptly responding to frequently asked questions.

2. Robotic Process Automation (RPA): RPA automates manual tasks such as data entry and document processing. This makes operations more efficient and cuts down on mistakes.

3. Fraud Detection in Real Time: AI looks at vast amounts of data to quickly find and stop fake activities.

4. Personalised Services: AI uses customer information to make product suggestions, special offers, and financial tips tailored to each person.

5. Advanced Risk Management: AI assists in analyzing data, predicting trends, and evaluating risk to make precise decisions and manage risk effectively.

Q.4- What are role of artificial intelligence in banking sector?

A- Generative AI has several significant applications in banking:

1. Better Fraud Detection: By modelling different types of fraud, generative AI makes detection algorithms better. This makes systems that stop fraud more reliable and quick to react.

2. Risk Assessment and Credit Score: Generative AI creates detailed simulations of financial scenarios that give us more information about credit risks. This makes credit score models more accurate.

3. Document Processing Automation: Automating the creation and processing of complicated bank papers makes it easier to work with them.

4. Personalised Customer Experience: Generative AI analyses a large amount of customer data to make personalised marketing efforts that keep customers interested and make them happier.